Debt can cast a shadow over an individual’s life. Regardless of how they incurred the debt, the inability to settle it in a timely fashion can do more than harm the person’s credit score. It can also cause a pervasive sense of stress, especially if debt collectors are calling and sending a flurry of emails.

When you experience this situation, and you currently lack the means to end your indebtedness, what should you do?

To put your financial life back on course, you could pursue debt help from a debt consultant or a debt specialist, or you could seek the assistance of a credit counselor. However, while each option can help restore a healthy state of finance, they do so in different ways. Depending on your unique situation, one option may be a better fit than the rest. With that in mind, let’s look at the difference between these three professionals.

1. Debt Consultants

Debt consultants are financial professionals who specialize in advising people on how to achieve debt relief. Moreover, they help you develop a viable plan for paying off debt by managing your finances more effectively. In order to provide this type of debt help, a debt consultant performs a complete analysis of your current financial situation before potentially negotiating debt with your lenders.

Although debt consultants can work with creditors to reduce the amount of debt you owe, they may also help you address debt by suggesting other means, such as debt consolidation via their affiliates.

Debt Negotiations

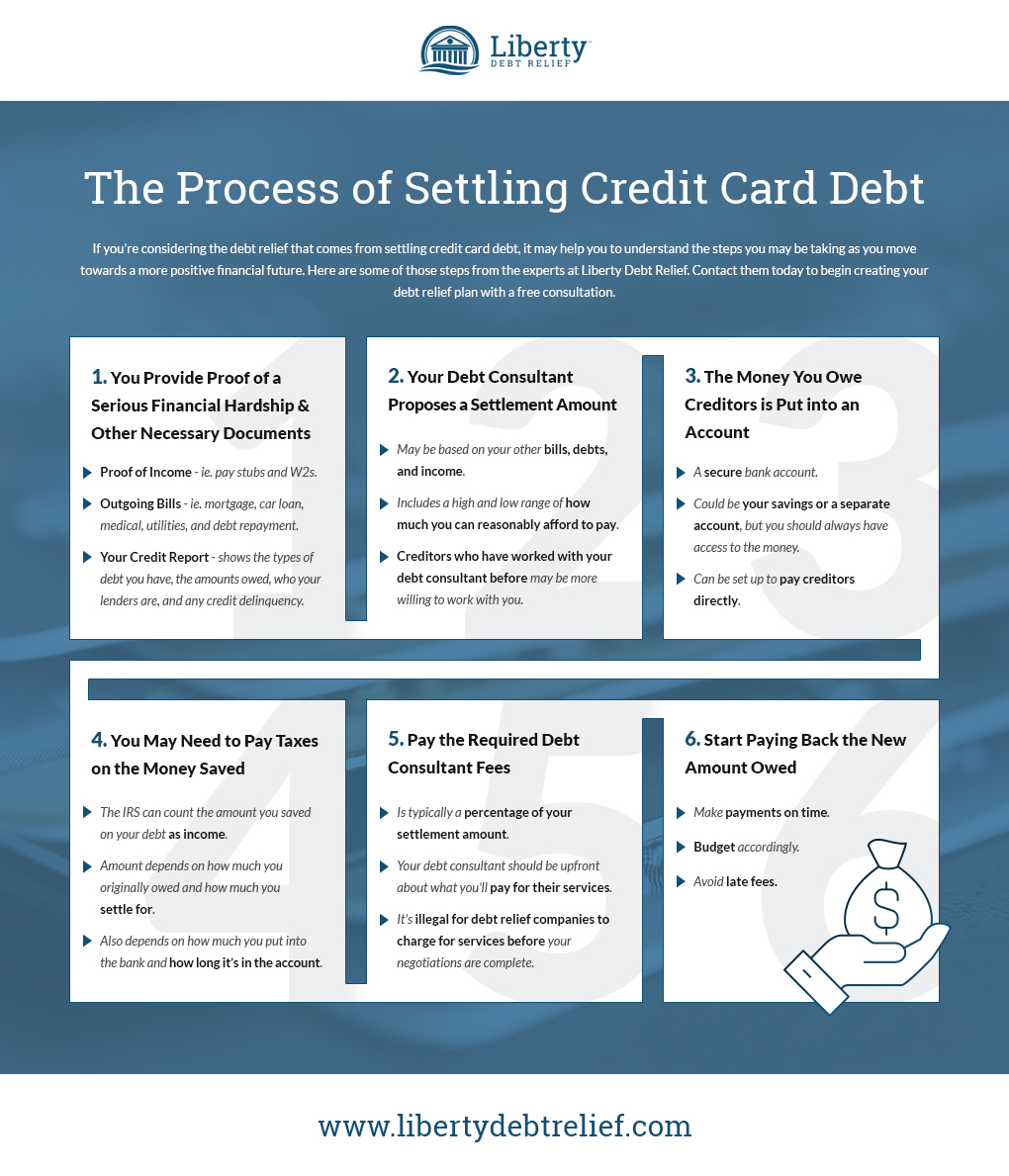

There are multiple steps to the debt settlement process, and a debt consultant can help guide you through each of these. First, you’ll demonstrate your financial hardship and the reason you need to negotiate your debt. Next, your consultant will review your finances and credit report with you to determine what portion of your debt you’ll be able to handal, which is typically expressed in a range. Next, the consultant will speak to your lenders on your behalf and, potentially, get them to agree to the smaller amount due. If your creditors agree, you will begin the process of repayment but for a much more manageable amount.

Debt Consolidation Planning

In a debt consolidation plan, you can roll multiple debts into one, allowing you to make a single, scheduled payment on the amount until it is paid in full. Because the consolidated debt may have a lower interest rate than the debts that comprise it, you can eliminate your debt faster. However, because the amount of the payment depends on the dollar amount of the debts consolidated, debt consolidation planning works best for debts that aren’t excessive.

Most people receive debt help through debt consolidation in one of two ways. They transfer debt to a balance-transfer credit card that has 0% interest during the card’s promotional period, then pay off the debt before the promotional period ends; or they receive a fixed-rate debt consolidation loan, use it to pay off their debt, then pay off the loan in installments.

2. Debt Specialists

Professional consumer debt specialists retain the title of “Certified Consumer Debt Specialist (CCDS)”, which they receive upon passing the CCDS exam from the Center for Financial Certifications. To retain the certification, specialists must complete 20 hours of continuing education every two years, dealing with a variety of personal finance disciplines, including: budgeting, debt load evaluation, avoidance and elimination of debt, and retirement planning.

Like debt consultants, one of the primary goals for debt specialists is to achieve a debt settlement agreement. In some cases, the payment could be 50% less than what you originally owed! Their expertise and ongoing relationships with creditors is why you should work with a debt specialist or debt consultant, instead of trying to complete these negotiations on your own.

3. Credit Counselors

A credit counselor is a third financial professional who assists people with getting their lives on track in the face of significant debt. Credit counseling organizations are usually non-profit entities that offer free or low-cost debt help services to their clients. In doing so,

counselors largely advise people on managing their money and debts, and help them budget payments.

Debt Management Planning

Debt management differs from debt consolidation in that it doesn’t involve loans that aid debt repayment. Instead, a debtor’s creditors collectively agree to repayment terms that the plan establishes. The debtor then makes scheduled payments to the credit counseling company that facilitated the debt help plan, and they disburse separate payments to each of your creditors.

In most cases, the plan doesn’t reduce the amount of debt owed. Rather, the monthly payment on a debt and/or interest rates are lowered to make it easier for those in debt to repay. When creditors agree to the plan, they also agree to halt debt collection efforts and not charge late fees, as they receive payments. Unlike some debt help agreements that are formed with creditors, agreements achieved with the help of credit counselor typically don’t have tax implications.

Conclusion

Debt consultants, debt specialists, and credit counselors use different methods to help people address debt, and eventually regain a good financial standing by doing so. Is one of these groups of financial professionals better equipped to help you?

The answer depends on certain factors, such as whether you have a high level of debt that is ideal to settle with a negotiated lump sum, or a lower level of debt that’s feasible to pay off in installments. At the same time, it’s important to look at which financial professional offers the most options, and the most holistic approach, on behalf of clients. That designation typically belongs to debt consultants.

Contact Liberty Debt Relief

If you need debt help with resolving personal debt, and you wish to pursue a new agreement with your creditors, don’t negotiate without a debt consultant on your side. Whether your debt is significant, relatively minor, or somewhere in-between, our experts atLiberty Debt Relief can provide the services you need for a new financial start. Contact us today to schedule a consultation for your debt situation. We look forward to helping you live outside of the shadow of debt.